Goaltide Daily Current Affairs 2020

Current Affair 1:

Asia Pacific Centre for Arbitration & Mediation (APCAM)

News:

APCAM (Asia Pacific Centre for Arbitration & Mediation) is an international ADR (Alternative Dispute Resolution) centre formed jointly by about ten arbitration and mediation centres from the Asia-Pacific countries, which host APCAM centres in their respective countries.

Vision of APCAM:

Few important points:

- This APCAM's structure of providing both mediation and arbitration service will allow the disputants to first settle their bone of contention without any interference and if that fails then try to resolve their disputes through arbitration.

- APCAM also empanels a common panel of international mediators and arbitrators, with uniform accreditation system from all the countries, which would help the parties to experience uniform high-standard practice, bringing credibility and professionalism of mediators and arbitrators.

- The administration of APCAM is done by an independent Governing Board comprising of nominee Board members from each constituent institutions, who are some of the best arbitrators, mediators or ADR professionals from the Asia-Pacific region.

- APCAM also has an Advisory Board, comprising of the most experienced and credible names in the field from all over the world. They guide the Institution on procedural and ethical aspects concerning ADR.

- When you opt for APCAM mediation or arbitration, you enjoy the benefit of resolving disputes in any of the constituent member countries under a single system with administering centres in all countries.

India is a member of it or not?

Yes, India (Indian Institute of Arbitration & Mediation (IIAM)) is a member.

Secretariat:

The institutional member that nominated the APCAM Chairman shall serve as the APCAM Secretariat. The term of office for the Secretariat shall follow the term of the APCAM Chairman.

We will also see Arbitration and Conciliation (Amendment) Act 2019

It seeks to amend the Arbitration and Conciliation Act, 1996. The Act contains provisions to deal with domestic and international arbitration and defines the law for conducting conciliation proceedings. Key features of the Bill are:

- Arbitration Council of India:

- The Bill seeks to establish an independent body called the Arbitration Council of India (ACI) for the promotion of arbitration, mediation, conciliation and other alternative dispute redressal mechanisms.

- Its functions include: (i) framing policies for grading arbitral institutions and accrediting arbitrators, (ii) making policies for the establishment, operation and maintenance of uniform professional standards for all alternate dispute redressal matters, and (iii) maintaining a depository of arbitral awards (judgments) made in India and abroad.

- Composition of the ACI: The ACI will consist of a Chairperson who is either: (i) a Judge of the Supreme Court; or (ii) a Judge of a High Court; or (iii) Chief Justice of a High Court; or (iv) an eminent person with expert knowledge in conduct of arbitration. Other members will include an eminent arbitration practitioner, an academician with experience in arbitration, and government appointees.

- Appointment of arbitrators: Under the 1996 Act, parties were free to appoint arbitrators. In case of disagreement on an appointment, the parties could request the Supreme Court, or the concerned High Court, or any person or institution designated by such Court, to appoint an arbitrator.

- Under the Bill, the Supreme Court and High Courts may now designate arbitral institutions, which parties can approach for the appointment of arbitrators. For international commercial arbitration, appointments will be made by the institution designated by the Supreme Court.

- For domestic arbitration, appointments will be made by the institution designated by the concerned High Court.

- In case there are no arbitral institutions available, the Chief Justice of the concerned High Court may maintain a panel of arbitrators to perform the functions of the arbitral institutions. An application for appointment of an arbitrator is required to be disposed of within 30 days.

- Relaxation of time limits:

Under the Act, arbitral tribunals are required to make their award within a period of 12 months for all arbitration proceedings. The Bill seeks to remove this time restriction for international commercial arbitrations. It adds that tribunals must endeavour to dispose of international arbitration matters within 12 months.

Current Affair 2:

Health of the Schedule Commercial Banks in the Latest Financial Stability Report (FSR)

This is just one topic we took from report. It is just to give you fair idea what terms and parameters are used to determine the stability of Banks. No need to learn anything. Just see terminologies. I have not explained each terminology. Any term you don’t know, search it and find.

The Financial Stability Report (FSR) is a biannual report published by the Reserve Bank of India (RBI). The objective of the report is to review the nature and magnitude of risks, and their implications which can affect the macroeconomic environment, financial institutions, markets, and infrastructure.

This story focusses on the performance of Scheduled Commercial Banks (SCBs) as presented in FSR.

COVID-19 halted the improvement in credit demand of banks

- Credit demand in SCBs was slightly improving in early 2019-20. However, towards the end of the financial year, the improvement was halted as a result of the pandemic.

- Looking at the performance of SCBs, the already weakened credit growth in the first half of 2019-20, went further down to 5.9% in March 2020 and continued to reduce till early June 2020.

- The deposit growth also dropped in the latter half of 2019-20. In the initial months of 2020-21, there was an increase in deposit growth because of the precautionary savings behaviour due to the pandemic.

GNPA ratio of all SCBs had declined in March 2020 as compared to September 2019

- Meanwhile, the Gross Non-Performing Asset (GNPA) ratio of all SCBs which was 9.3% in September 2019 has declined to 8.5% in March 2020.

- During the same period, the Net NPA dropped from 3.7% to 3%. This indicates that the performance of banks had improved.

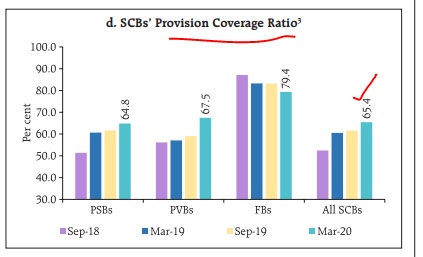

- The Provision Coverage Ratio improved to 65.4% from 61.6% over this period.

- The capital to risk-weighted assets ratio (CRAR) of SCBs also dropped down to 14.8% in March 2020 from 15% in September 2019.

Hope you are familiar with all the above terms. If not search in google or any source.

Stability of banking sector

Five indices based on the five dimensions of Soundness, Asset Quality, Profitability, Liquidity, and Efficiency, are analyzed to assess the impact of underlying conditions and risk factors on the stability of banking sector.

SCBs had recorded a decline in the dimensions of soundness, liquidity, and efficiency in March 2020 compared to September 2019, contributing to a decline in stability of the sector, while a marginal improvement in asset quality, and profitability was recorded.

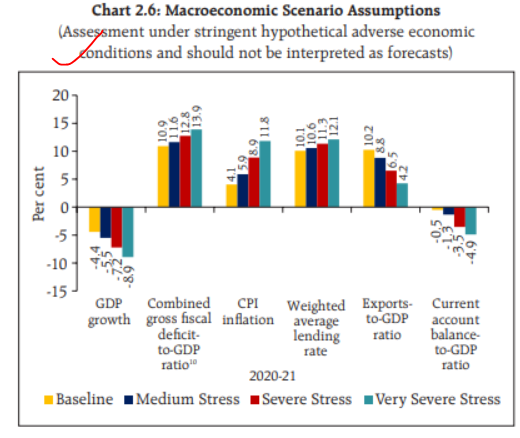

RBI takes into consideration four different scenarios and evaluates a bank’s financial position at these hypothetical conditions which help in decision making within the bank. One is the baseline scenario which is derived from the projected values of macroeconomic variables. The other three adverse scenarios- medium, severe, and very severe, are calculated for worsening macroeconomic indicators as indicated in the chart below.

GNPA ratio is expected to increase to up to 14.7% in the worst-case scenario

- The stress test covering 53 banks revealed that the GNPA ratio of all SCBs may increase from 8.5% in March 2020 to 12.5% by March 2021 under the baseline scenario or the forecasted macroeconomic environment.

- Further, based on the type of bank, GNPA ratio of public sector banks may go up from 11.3% to 15.2% during the same period under the baseline scenario. That is, more loans are in the danger of not being repaid.

Around 20 banks may end up dominating the list of largest capital erosion

- The report mentions that capital erosion is anticipated.

- From 14.6% in March 2020, the CRAR is projected to drop to 13.3% in March 2021 under baseline scenario.

- It is further expected to drop to 11.8% in the worst-case scenario with five banks failing to meet the minimum capital level.

Governor of RBI stated that India’s financial system is sound

- In the foreword of the report, RBI Governor Shaktikanta Das stated that India’s financial system was sound, and that priority has been given to the need for financial intermediaries to proactively augment capital and improve their resilience.

- Financial sector must be stable to boost the confidence of businesses, investors, and consumers.

- The report added that a combination of fiscal, monetary and regulatory interventions on an unprecedented scale has ensured normal functioning of financial markets and the actions undertaken by financial sector regulators and the government to mitigate the impact of the pandemic helped reduce operational constraints and maintain market integrity and resilience in the face of severe risk aversion.

It remains to be seen if the predictions made in the report come true.

Current Affair 3:

PM Street Vendor’s AtmaNirbhar Nidhi (PM SVANidhi)

News was:

The Union Housing and Urban Affairs Ministry recently said over 5 lakh applications had been received under the PM Street Vendor’s AtmaNirbhar Nidhi (PM SVANidhi) scheme for street vendors since it started on July 2 and 1 lakh loans had been sanctioned already.

What is the Scheme?

This is a Central Sector Scheme to facilitate street vendors to access affordable working capital loan for resuming their livelihoods activities, after easing of lockdown.

What are the objectives of the Scheme?

- To facilitate working capital loan up to `10,000 at subsidized rate of interest

- To incentivize regular repayment of loan; and

- To reward digital transactions.

What are the salient features of the Scheme?

- Initial working capital of up to `10,000/-

- Interest subsidy on timely/ early repayment @ 7%

- Monthly cash-back incentive on digital transactions

- Higher loan eligibility on timely repayment of the first loan

Who is the target beneficiary for the Scheme?

Street vendors/ hawkers vending in urban areas, as on or before March 24, 2020, including the vendors of surrounding peri-urban and rural areas.

Implementing agency:

Recently, the Ministry of Housing and Urban Affairs signed MoU with Small Industries Development Bank of India (SIDBI) in order to engage SIDBI as the Implementation Agency for the scheme.

Which lending institutions will provide credit?

Scheduled Commercial Banks, Regional Rural Banks, Small Finance Banks, Cooperative Banks, Non-Banking Financial Companies, Micro-Finance Institutions and SHG Banks. 8.

What is the tenure of the Scheme?

The Scheme shall be implemented up to March 2022.

Current Affair 4:

New study sheds light on genetic affinities of Gujjars and Ladakhis

The Union Territories of Jammu and Kashmir (J&K) and Ladakh in North India, with their wide variety of landscape, are a congruence of several languages and cultural practices. The region is believed to have served as a corridor for ancient human migrations between the Indian subcontinent and North-East Asia, Eurasia and Africa.

The populations in the region offer a unique opportunity to investigate the past anthropological and demographic events which might have shaped the extant human population diversity. In a new study, scientists at the Department of Biotechnology’s Centre for DNA Fingerprinting and Diagnostics (DBT-CDFD) have sought to decipher the genetic diversity encompassed by Gujjars from the Jammu region of J&K and the Ladakhi populations.

Previous study:

A previous study had found that the two communities — Gujjars and Ladakhis — exhibited lower genetic affinity towards other populations in their geographical proximity. To better understand the genetic diversity in these populations, a battery of DNA markers located on autosomes, Y-chromosome and the mitochondrial genome were employed.

The principal coordinate and cluster analysis based on autosomal DNA markers indicated Gujjars and Ladakhis were genetically distant to each other as well as to other reference populations of India, which was in concordance with Y-chromosomal analysis.

The present study is the first comprehensive attempt to determine the genetic relatedness of the Gujjars and Ladakhis to populations within India and elsewhere in the world and would help in gaining deeper insights into genetic diversity and demographic settlement in this part of the world.

Current Affair 5:

Hornbill Habitat Loss

A study based on satellite data has indicated a high rate of deforestation in major hornbill habitats in Arunachal Pradesh and a part of Assam.

Learn about Hornbill with respect to India:

India has nine hornbill species, of which four are found in the Western Ghats: Indian Grey Hornbill (endemic to India), the Malabar Grey Hornbill (endemic to the Western Ghats), Malabar Pied Hornbill (endemic to India and Sri Lanka) and the widely distributed but endangered Great Hornbill. India also has one species that has one of the smallest ranges of any hornbill: the Narcondam Hornbill, found only on the island of Narcondam.

Conservation Status (Great Hornbill):

- Currently, 26 out of the 62 species (40%) of hornbills are Globally Threatened or Near Threatened with extinction, with all other species listed as Least Concern, according to the International Union for Conservation of Nature (IUCN) Red List of Threatened Species.

- The great hornbill is evaluated as vulnerable.

- It is protected at the highest level under Schedule I of the Wildlife Protection Act, 1972.

<< Previous Next >>